QuickBooks Error 30159 showed up on your screen? Then it is a sign that there’s a problem with your Paysub.ini file. This is the file which stores payroll subscription information.

QB error 30159 appears on the screen with a message that says, “Can’t verify Payroll Subscription Error 30159.” Do not worry if you don’t know how to resolve the error with ease.

There are many possible reasons for QuickBooks Error 30159 to occur. If you also want to know the reason, then stay tuned with this article.

We tried to ease your problem with the goal of sharing every information with you about this error.

QuickBooks Error 30159 – Know in detail

QuickBooks Error 30159 is a payroll error which is seen when users payroll subscription is expired. This error can also appear when user will try to install or upgrade QuickBooks Software.

Error Description: Error:30159 QuickBooks has encountered a problem and needs to close. We are sorry for the Inconvenience

Most ordinary reasons for QuickBooks Error 30159

What I have found is that most people experience QB error 30159 because of some common reasons, which we tried to put in this blog to clear all your confusion related to the error.

| Reason for Error | Description |

| Outdated QuickBooks Version | The error can occur when using an outdated version of the QuickBooks application. |

| Corrupted or Damaged Data | If your data is corrupted or damaged, the error can appear. |

| Incorrect Employer Identification Number (EIN) | The error may occur when the Employer Identification Number (EIN) is incorrect. |

| Expired or Inactive Payroll Subscription | The payroll subscription must be active; if expired or inactive, the error can arise. |

| Multiple Active Payroll Agreements with Inactive Direct Deposit | Having multiple active payroll agreements alongside an inactive Direct Deposit agreement can cause the error. |

| Incorrect PSID (Payroll Service Identification Number) | The error may appear when the PSID in your company is incorrect. |

| Damaged [paysub.ini] File | If the QuickBooks Desktop file [paysub.ini] is damaged, the error can occur. |

| Outdated Windows Operating System | The error may appear if you are using an outdated version of Windows. |

| Invalid EIN or Service Number | The error can show up when the payroll subscription status displays an invalid EIN or service number on the screen. |

Most of these errors can be easily avoided if you Don’t skip to learn Payroll Setup in QuickBooks Desktop in compliance with IRS guidelines.

Easy methods to resolve QuickBooks error 30159

We tried to make things easier for you. You don’t have to worry about anything anymore. Just follow the solutions given below to manually resolve QuickBooks Error 30159:

Method No. 1: Verify the status of the Payroll Subscription

After researching and talking with QuickBooks users, I discovered that the most common reason behind QuickBooks Error 30159 is the inactive status of users’ payroll subscriptions.

When the QuickBooks error 30159 appears on the screen it becomes important for you to verify the subscription status to rectify the error.

If in case you are also facing the same issue, then follow the mentioned steps below:

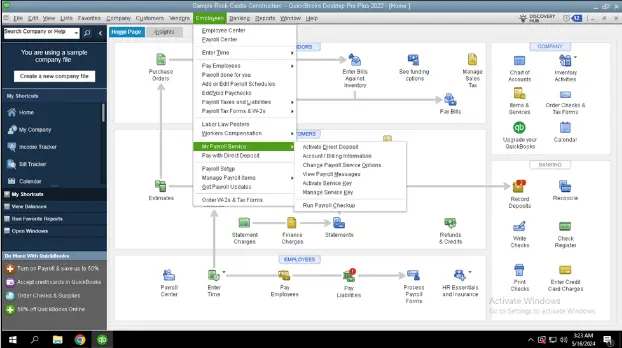

- First, open your QuickBooks Desktop application and move your cursor towards the top. Now, click on the Employees tab, and from there select My Payroll Services.

- After that, choose Account and Billing Info.

- There you need to fill up the boxes with your Intuit login credentials and then click on Sign In.

- Further, confirm your account info by choosing the method you want to verify your identity

- You will now receive a 6-digit verification code, it can be either on your phone number or email.

- Enter that code in the box, and click on continue.

- Once you have logged in, try to update your payroll subscription tax table and check whether Error 30159 has gone or not.

Issues related to the payroll subscription can lead to delayed tax filings and discrepancies in liabilities. Additionally, error 30159 could affect Direct Deposit paychecks.

Therefore, we need to double-check the status of our liabilities and direct deposits by reviewing the relevant reports. Find out How to create a Payroll Report in QuickBooks Desktop in fewer clicks.

Method No. 2: Upgrade your system to the latest version

If you were not able to resolve the QuickBooks Error 30159 with the above methods, then don’t worry we have more for you.

It looks like your system is not updated to the latest version and is running on an older version. If in case you have an updated system then you can skip this method and move to the other. Using an older version can lead you to Error code 30159. However, you can fix this by manually updating the system. Follow the steps mentioned below:

- Start by, signing in to your system as an Administrator

- After that, click on the start button and then choose All Programs.

- Now, you will see the Accessories option, click on it and then tap on the screen.

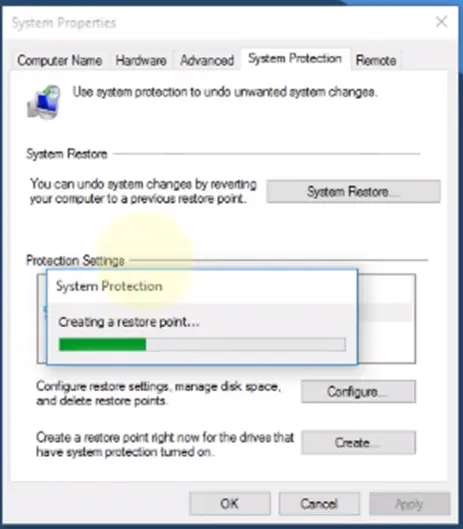

- Select system tools, then from the new Window, hit System Restore.

- Further, search for Restore my computer to an earlier time and after that, tap on Next.

- Once the confirmation window appears on the screen, you have to wait for some time for the process to be completed.

- In the end, restart your system, and you are done.

Running QuickBooks on a terminal server requires updating the QuickBooks application and Database Manager on the Server. If you receive QuickBooks Database Server Manager Network Diagnostics Failed, check out our detailed guide to resolve the issue.

Method No. 3: Clean your disk

Sometimes just cleaning your disk can resolve the QB error 30159. If you don’t know the process behind the cleanup, then follow the steps mentioned below:

[For Windows 7, 10 and 11]

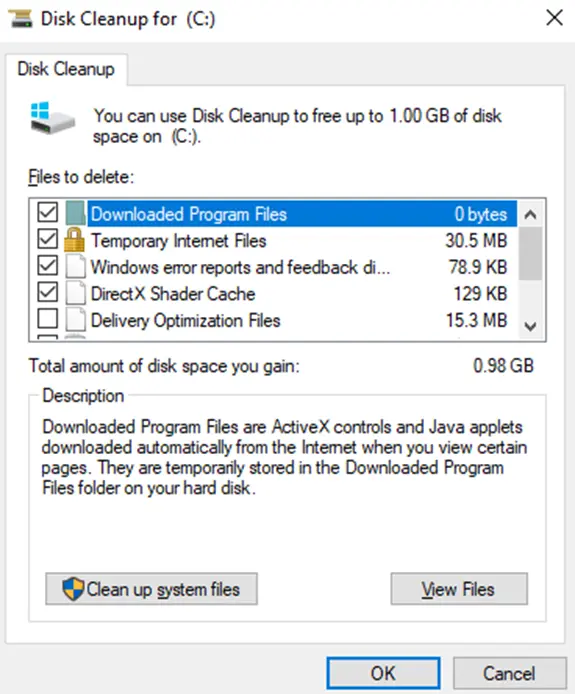

- Initially, go to the start button, and in the search bar type “Disk Cleanup” and press enter.

- From there, go to the list of drives and then select the system drive.

- After selecting the drive, go to the list of files.

- Now, select the files you want to remove.

- At last, click on OK and remove the files button.

[For Windows 8, 8.1]

- In this step, you need to go to My computer.

- After that, search for settings and click on it.

- Now, search for the control panel either on your desktop or in the start menu.

- From there, click on the Administrative Tools.

- There you will see the disk cleanup option, tap on it.

- Further, you need to go to the list of drives and then click on the drive you wish to delete.

- Now, move toward the list of files, select all the files you want to delete, and then click on OK.

Method No. 4: Add the Employer Identification number to the company file

If your Employer Identification number is not correct or missing then it is for sure that the QuickBooks error 30159 will appear as EIN is the most important part of your company file.

Don’t worry you can still add your EIN to the company file and resolve the error. Here’s how:

- First of all, Sign in to your QuickBooks application.

- After that, right-click on the employee tab and click on payroll.

- Now, select My Existing Payroll Service.

- Further, click on the subscription number from the identify subscription option.

- Click on I have an existing subscription and a Zip code and feed in your information.

- Here, tap on Add company information and open it. After this, click on next to add your EIN.

- You can end by printing it or else return back to QuickBooks Desktop.

IMPORTANT: The service will get included on its own and a payroll subscription window will also be opened up.

It is important to Check the service key, just follow the steps:

- First, click on the Employees tab and then choose My Payroll Service.

- After that, you need to select Manage Service Keys.

- If you want to display the new service key then click on view [But with an active status]

NOTE: In case you have bought the QuickBooks Desktop subscription from Intuit itself and haven’t created the company file. Then the steps to resolve QuickBooks Error 30159 are different.

Follow the steps provided below:

- Keep in mind the service key of the Employer Identification Number, which you will be adding.

- Now, go to the Employee tab and then click on Payroll. After that, choose Payroll Service Key from there.

- Enter the service key by clicking on add [ Do not use any special character between them].

- In case the payroll service key was present in the company file until now, then click on edit rather than add.

- Further, type the service key. Tap on Select and then click on Finish.

- After this process, a fresh tax table will be included, and each payroll function will start getting activated in the file.

- Updated payroll tax tables ensure that the correct amounts are withheld and reported. Discrepancies in payroll liabilities may occur due to incorrect tax tables. After successfully updating the tax tables, you can Adjust Payroll Liabilities in QuickBooks in 4 Easy Ways to fix these discrepancies.

Method No. 5: Change the name of the Paysub.ini file

Paysub.ini files store the payroll subscription data. It is very essential for payroll subscription information. In case the Paysub.ini file gets damaged or even corrupted, it can trigger Payroll Error 30159 to occur.

But it is very easy to resolve the issue, all you need to do is change the name of the file and it will stay the me for a long time. Here’s how:

- To begin with, go to My Computer, and there click on Organize.

- Now, click on the folder, and search for the option.

- After that, you will see the view tab in the middle of the general and search options.

- Further, under the advanced settings, click on hidden files and folders and then check mark the show hidden files, folders, and drives.

- You need to select Apply and tap on OK.

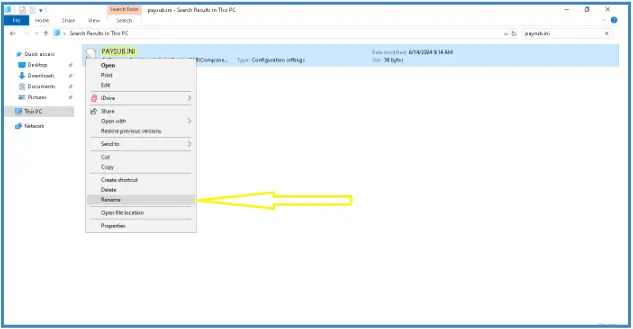

- Reopen My computer and now search Paysub.ini from the search bar.

- Open the file, then right-click on it, and tap on the option rename.

- Lastly, Change it to .old from .ini. And verify whether the error is resolved or not.

Wrapping up!

In case you are still finding it difficult to resolve the QuickBooks Error 30159, you can install some good antivirus software on your system.

However, if you want to save your time, then you can take the help of our certified professionals by contacting us on our toll-free number 1(805) 419-9019. Our team are experts in this profession and have many years of experience.