QuickBooks is a very fine accounting software that provides its users with some great benefits. One such benefit is the QuickBooks Direct Deposit form. Through these businesses can directly transfer salaries into their employee’s accounts.

Not only that, employees can get their money the same day or the next day, other software requires three to four days to process. It’s beneficial for every kind of business or you can say employer because there will be no delay for bank reconciliation purposes. It’s good for employees too as they can receive their payment immediately.

In this article, we have discussed the QuickBooks Direct Deposit form in depth. If you also want to know about it in detail, kindly stay tuned with us till the end.

What is the QuickBooks Direct Deposit form?

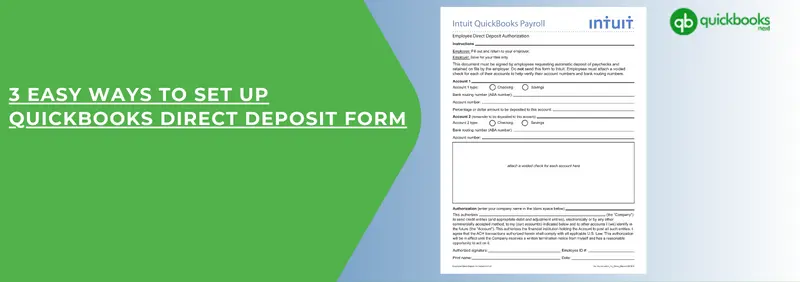

QuickBooks direct deposit form permits some third party or you can say an employer for the payroll purpose. Through this, you can send salaries to your employees by just using the bank details of their account.

An employer can ask for any of their employee’s canceled cheques to verify their accounting details. For this employee need to fill out the form, and after that, they need to sign and return it to the employer.

You can set up QuickBooks Direct Deposit to make the payroll process much easier. The larger part of the employee’s section wants to receive their salary through direct deposit.

Why choose QuickBooks Direct Deposit?

Sometimes managing payroll can be a burden, so to make payroll easier for you Intuit came up with a Direct Deposit form. If you are new to this and want to know the benefits of it, read everything mentioned below:

Direct Deposit is very beneficial for employers and employees too

Direct Deposit is good for both employers and employees.

For employers, because it can cut out their expenses, also makes sure that the deposits are on time, can give them control to process payroll.

For employees, because they don’t have to be present in person to receive the salary, they can be anywhere and receive the salary through Direct Deposit. Also, it can nullify check fraud [No more stolen or lost cheques]

Recommended: QuickBooks Payroll Services and Features for QuickBooks Desktop

QuickBooks Direct Deposit is in demand

As mentioned, QuickBooks Direct Deposit is in demand, it is because it has the potential to directly deposit on the same day itself or the next day. Otherwise, all the other software takes at least 3 to 4 days. You don’t need to worry about the salaries of your employees as you can deposit the funds on the same day by processing payroll.

QuickBooks provides you with a lot of offers, one such offer is add-on options for payroll. Although, this completely depends on the number of employees you have.

There are some more benefits of the QuickBooks Direct Deposit form:

- On the day of the salary, money is directly sent to the employer’s bank account.

- You can get access to funds anytime you want.

- After the employee has received the salary, he or she will have quick access to it.

- It is a very practical and successful mode of payment.

- For the amount clearance, you don’t need to wait for the cheque.

- Employers can start the process of transferring salaries to the employee’s account, before the day of salary.

- There won’t be any chaos with cheques because of the QuickBooks Direct Deposit form.

Some important things to do before setting up QuickBooks Direct Deposit

If you have already started setting up QuickBooks Direct deposit, then stop. Before doing that, you neSed to perform some following steps to set up Direct Deposit, otherwise, it can get difficult for you to proceed with QuickBooks payroll Direct Deposit.

- Enter your bank or financial institution details.

- Enter your bank’s routing number

- Then your account number

- After that, the name of your employee’s bank or financial institution

- Then the employees’ banks’ routing numbers

- Lastly, employees’ account numbers

Expert Recommendation: Adjust Payroll Liabilities in QuickBooks in 4 Easy Ways

How to write a QuickBooks Direct Deposit Form?

If you wish to deposit salaries directly into the employee’s account, then the first thing you need to do is fill up the QuickBooks Direct deposit form. After you are done with the filling process of the direct deposit form, QuickBooks accounting software will help you by automating the payment process for all the employees of your company.

Note: Before filling the direct deposit form make sure that your business information is not incomplete and you have authentic tax information. Take all the necessary steps and set everything you need to pay your employees.

If everything is already completed, then you will see checkmarks show up on the QuickBooks screen. Once you are done with all this, follow the steps given below to set up Direct Deposit for employees in QuickBooks Payroll.

Step No. 1: Connect to your Bank by selecting the start

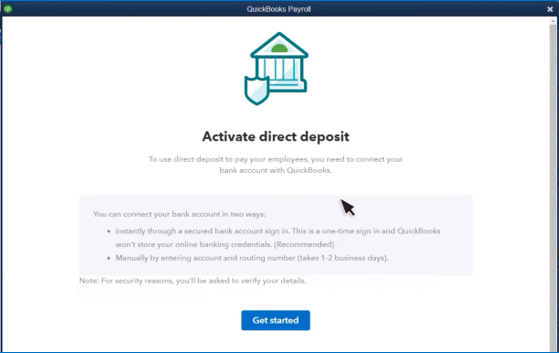

- Sign in to QuickBooks Online, and click on Start. After that, select connect your bank.

- Now, click on Get Started. A new window will be opened [This will check all the information you have entered].

QuickBooks can ask Questions related to the company’s principal officer [ Most probably you will be the company’s principal officer if in case you own the sole proprietorship of the business.] Be prepared with the information like:

- Social security number

- Legal full name

- Home address

- Date of birth

Once you are done with the above process, follow the steps given below to complete the process.

- You need to find your bank by adding a new bank option.

- If you were able to find your bank, proceed by choosing your bank.

- After that, provide all the information regarding the account numbers of your employees to whom you want to pay.

Note: QuickBooks also permits you to add your bank account. You just need to sign up into your bank for authentication.

- Once you have linked your account, proceed by adding up your personal identification number [This will protect your bank account].

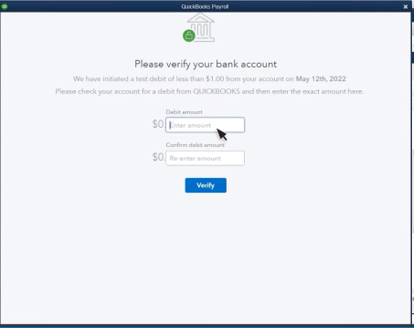

- Further, check whether the QuickBooks have sent you some small deposit to your account or not. It is done for verification.

- The credit which QuickBooks will send you will be listed as, “Intuit: Verify Bank” or “QuickBooks: Verify Bank.” [ The credited amount will be no more than $1].

- Now, through your email, you will receive a verification email

- In the end, your account will be verified.

In case, you have not received any kind of email related to verification, then go to your QuickBooks account login, and then click on the overview to check the deposit amount.

Step No. 2: Complete the verification process of all the employees

Before the verification of your employees, it is important for you to verify your account first. Do not skip the above step. First of all, you need to enter all your employees’ information.

After that, you need to take the printout of the direct deposit form and ask all the employees to fill them up. Keep the file in any of the forms either digital or physical, just store these forms somewhere safe.

Some checking should be done along with every finished direct deposit form. This will give you the account number of each employee. This helps you in setting up QuickBooks Direct Deposit very easily.

If you want to have the authorization for direct deposit form. Then follow the mentioned step below:

- To begin with, you need to tap on the Taxes and Forms.

- After that, click on Employee and Contractor Setup.

- Now, choose Authorization for Direct Deposit.

- Lastly, click on bank verification and check whether it’s done or not.

If you want, you can take out printed copies, specifically for your employees, so that they can fill them out. Although, QuickBooks users usually give preference to employees signing up for Direct Deposit. In order to make payroll more effective. They do not want to struggle with the printed forms for some employees.

Step No. 3: Fill up the banking information of employees

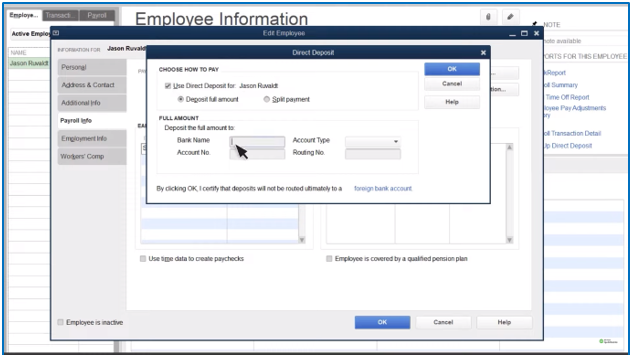

After all the above steps, this one is the most important as you need to enter the employee’s banking information without any chaos.

- In this step, you need to search for the employee’s tab.

Note: In case you filled up employee information in QuickBooks already, then it would become easier for you to enroll your employees in Direct Deposit. You just need to choose each employee and click on set up.

- After that, click on Add an Employee.

- Further, provide all the information about the employee, like name, hire date, date of birth, tax details, and type of pay.

- Here, you will notice that under every employee an option is given, that says, how do you want to pay?

- If you want to keep your mode of payment Direct Deposit, then click on that option.

- Lastly, enter the banking information of the employee and press enter.

Wrapping up!

Through this article, we tried to inform you about the QuickBooks Direct Deposit in a very detailed manner. If even after that you are stuck somewhere and not able to understand about it or have any queries related to it, do not hesitate to contact us. Pick your phone and call us on our toll-free number +1(805)-419-9019 to get the right assistance from our certified experts.