To create QuickBooks period copy, one should know a set of systematic steps so that there is accuracy and completeness. Making a copy of a particular period on your QuickBooks Desktop can help you maintain organized and safe records.

Sometimes businesses are required to share the data in adherence with state or legal authorities. In that case, condensing the entire company file to some other party can create issues. Banks and accountants can also ask for the same to keep a check on your organization.

This article emphasizes the crucially of having a comprehensive and error-free record prior to starting the period copy. With the help of Period copy, you can send the condensed data to the person asking for it. Also, you can shorten the period of the data file as per your need.

Whenever users try to create a QuickBooks period copy, there are chances of facing some issues, that may become a barrier in the process and might hamper the user’s company file. To ignore such complexity, you can contact QuickBooks professional at the given toll-free number 1(805)-419-9019.

QuickBooks Period copy – Know more about it

The period copy in QuickBooks permits you to share data for some particular timeframe with third-party users like investors, IRS, and banks.

It is also very helpful for different purposes such as sharing financial data with accountants, making historical records, etc. When this feature was not available, businesses had to hand over a copy of the whole company file to third parties.

Let us understand this with an example, suppose a legal authority is asking for an audit of your company’s books for a particular tax year. In normal cases, users will make a backup of the whole company file and send it to the auditor.

But with the period copy feature provided by QuickBooks users are permitted to create a copy of their company file.

Period copy allows you to create a fresh file whenever you encounter the following scenario:

- Audit

- Legal Disputes

- Large file sizes

- Creating a fresh organizational entity

- Selling a specific organization

- IRS

What are the ways to create a period copy in QuickBooks?

A few things are important that you should know prior to beginning the procedure, you need to ensure that all your records are free and finished of any discrepancies for the period you intend to copy.

Given below are the following steps for how to create a copy of a period in QuickBooks:

- First of all, open your desktop, and then double-click on QuickBooks.

- Now, go to the menu bar which is located at the top, and then tap on the file menu.

- After that, click on Utilities and choose Condense Data Utility from the sub-menu.

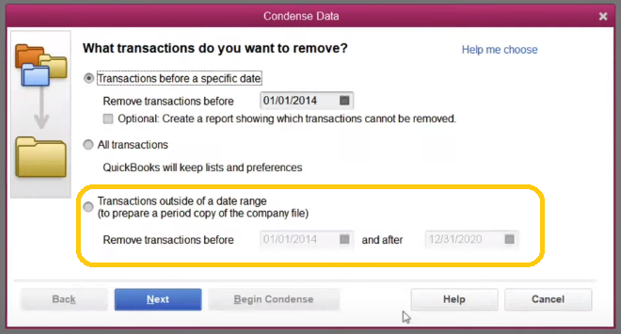

- Here, you need to choose “Transactions outside of a data range [to prepare a period copy of the company file]” from the 3 options given, in the next window.

- You will see an option written as, “Remove transactions before and after.” in the given boxes enter the date of the time applicable for the period.

- Further, click on next, and then as per your requirement, select the summary journal entry you want.

- Then, choose the Summarize Inventory Transaction, followed by next.

- You now choose every listed record and from the Condense data window, click on Begin Condense.

- If you need any kind of assistance, you can click on the help button.

Note: In case you want to send the period copy to your accountant, then there is a substitute step provided, follow that for more security.

- Initially, open QuickBooks, then from the menu bar click on the file menu.

- Then, select Accountant’s copy and tap on Client Activities.

- After that, choose Send to Accountant and then you need to make the confirmation for the creation of an Accountant’s copy.

- Now, you need to enter the time period of the file you wish to transmit after choosing the next.

- Further, give in all your information asked and submit the email address of the accountant.

- Choose next and then generate a password for encrypting the file transfer,

- Don’t forget to send the password to your accountant.

- Finally, click on send.

Things to do if you are unable to create a period copy of QuickBooks

In the process of creating a period copy, there will be two things that might hamper your process of creation. You should know about those two causes and their solutions to tackle the issue at any point of time.

They are as follows:

Cause No. 1: When the company file gets corrupted or damaged

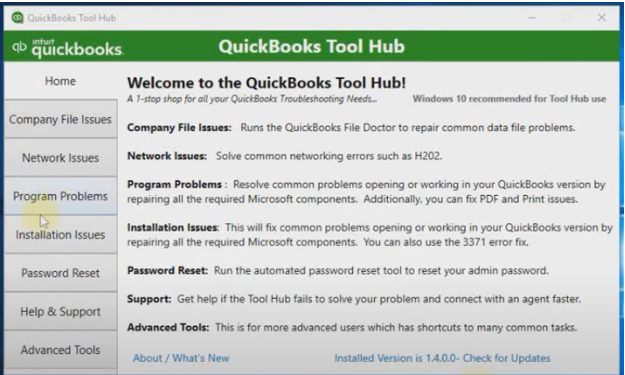

Solution: From the QuickBooks Tool Hub, Run QuickBooks File Doctor Utility

QuickBooks has provided its users with, QB File Doctor Utility. This feature can solve any file issues with ease. The problem is the condense data utility won’t be able to run till the company file becomes issue-free, but don’t worry we have QuickBooks File Doctor.

To run QB File Doctor, you need to follow certain procedures. Given below are the steps you need to follow:

- To begin with, go to Intuit’s authentic webpage, then install the tool hub. But first, you need to download it.

- Now, go to the tool hub, then to the left pane, and then select company file issues.

- After that, you need to tap on Run QuickBooks File Doctor. You need to be patient here as it might take some time to open.

- There you will see a drop-down menu, select the company file from there.

- Further, tap on the check your file option and then click on continue.

- To continue with the process, you need to type your QuickBooks admin credentials and click on next.

- In the end, complete the scanning process, and try the condense data utility tool once more to create the period copy.

Handpick Guide: 3 Easy Ways to Set Up QuickBooks Direct Deposit Form

Cause No. 2: When QuickBooks has on-hand inventory with negative quantities

Solution: In the inventory, repair the negative quantity

Negative inventory can result in incorrectness in the cost of goods sold on the profit and loss report. This may result in account reconciliation complications and with such complications, the company file won’t be able to condense data and submit it to the relevant analytics.

Proceed with the provided steps below, to avoid any future consequences:

- At first, you need to go to your desktop and open QuickBooks.

- Then, click on the reports menu.

- After that, you need to tap on Inventory, and from the sub menu, select Inventory Valuation Summary.

- Now, some incorrect values are shown in front of you, double-click on any of them to open the Inventory Valuation detail report of the given item.

- Further, you need to tap on the very first bill from the list.

- A new window will be opened as “Enter bills.”

- You need to change the date on the bill. The date should be before the time of the first invoice that is provided in the Inventory Valuation Detail report.

- Lastly, in order to store the adjustment, choose save and close.

Note: For each inappropriate value on the report, you can perform the last four steps again.

To sum up!

After going through this article, we hope that you now know how to create QuickBooks period copy. It is a very straightforward procedure, but it may require some assistance from a certified professional.

I would suggest you abstain from executing anything in company data as it might hamper your files and lead to data loss. Even if the information is error-free, human error can still complicate the situation. To ignore such complications, you can contact our QuickBooks expert team on our toll-free number 1(805)-419-9019. They will provide you with great technical assistance and will solve all your queries.