QuickBooks has offered its users one of the best features i.e., Payroll Reports. Payroll Report in QuickBooks Desktop can create numerous reports from the application. This feature is generally used to overview the payroll of your business and then decide the financial conditions of your business.

The payroll report in QuickBooks Desktop helps you determine the latest payments for a month, half, quarterly, or full year to the state for tax on payment. These reports serve as extremely useful tools. These reports are of many types and have multiple advantages like transparency, help in decision-making, etc.

Do you also want to know about the payroll reports in QuickBooks Desktop? Then let’s delve into it with the help of this article. We have discussed everything about payroll reports in detail. Stick to this article till the end.

What are Payroll Reports in QuickBooks Desktop?

In QuickBooks, payroll reports are a document that consists of numerous aspects of a company’s payroll activities. For example, details about employee taxes, deductions, compensation, and contributions.

This report is created with the help of company records and information. Many payroll reports are limited to a specific time period such as total pay, the first day of a month, or quarterly for the total accounting year.

This feature offers you the review of payroll payments and also helps organizations handle and trace their financial data related to employee payments. Payroll Reports are of numerous types, some of the most used ones are, tax liability reports, payroll summary reports, employee earnings reports, deductions/contributions, etc.

We have explained the usage of these reports in brief with the help of this article. This basically helps business organize their financial records, and inform decisions related to payroll handling.

What are the types of Payroll Reports in QuickBooks Desktop?

QuickBooks provides its users with 17 types of payroll reports. They can be used for many purposes and users can modify them as per their requirement. You can change the date, work location, employee, etc.

| PAYROLL REPORT NAMES | EXPLANATION |

| Paycheck History | This includes the summary of old salary payments, the mode of payment, and the latest status of paychecks |

| Payroll Billing Summary | This has the charges invoiced to your QB Payroll subscription |

| Payroll Deductions/Contributions | This report has the combined sum of the company contributions and employee deductions |

| Payroll Tax Liability | This report includes a complete payroll tax i.e., what are the taxes due and the portion that has already been paid |

| Payroll Details | This contains the details of paychecks. For example, taxes, amounts, deductions, etc. |

| Payroll Tax and Wage Summary | This report comprises taxable salaries subject to federal and province/state withholding |

| Payroll Tax Payments | This has the payroll tax payments made by you. |

| Payroll summary | Everything related to paychecks like total taxes, wages, and deductions |

| Employee Details | This includes deductions, pay rate, tax withholding, and contact information |

| Employee Directory | This comprises of employee emails, employee phone number, their work location, and contact information |

| Total Pay | This report consists of total compensations for all the employees categorized by payment type, like hourly wage or salary |

| Total Payroll Cost | This involves the costs of every expense compensating your employees, net pay, deductions, taxes, and encompassing overall pay |

| Vacations and Sick leave | This report contains PTO (Paid time off) utilized and the remaining amount employees have left. |

| Workers Compensation | This report involves wages or salaries paid to every worker’s compensation class. It is used to manage forms for state agencies or insurance companies |

| Retirement Plans | This report has the contributions of both employees and the company |

| FFCRA CARES Act Report | The FFCRA (The Families First Coronavirus Response Act) CARES Act report includes wages/salaries and credits concerning COVID-19 pay methods. |

| Multiple Worksites Report | This consists of information to finish your numerous worksites report (if asked by the province/state) |

What is the importance of Payroll Reports?

Before using payroll report in QuickBooks, one should know its importance. Let us know why payroll reports are important for businesses:

1. Recordkeeping:

Payroll Reports help you with crucial documentation for the purpose of recordkeeping. This offers you a history of records in payroll transactions, which you can utilize during tax filings, or when addressing inquiries of the employee, or audits.

2. Decision Making:

This report also provides their users with the accuracy of labor costs and trends. This information is important in creating decisions about the employees or staffing level, budgeting, and all-inclusive financial management.

3. Employee Transparency and Accountability:

This helps businesses or organizations offer their employees information about the compensation they will receive, earnings, deductions, and contributions in detail and with transparency. This encourages the employees to be accountable for their work. This also builds trust within the labor force.

4. Financial Tracking:

Payroll reports help business owners keep a close eye on their financial data regarding employee compensation. This offers their users a comprehensive separation of salaries, wages, taxes, deductions, and Contributions, which enables appropriate financial tracking.

5. Budget Management:

Users can understand the payroll costs with the help of these reports, business owners will be able to handle their budgets in a better way. This consists of future payroll payments so that it can manage financial plans accordingly.

6. Auditing:

Payroll reports are important for an audit. This helps in serving a well-founded source of information that users can utilize to verify accuracy and transparency in payroll processing.

7. Tax Filing:

These types of report make the procedure of filing taxes much easier. It offers an integrated view of tax liabilities which makes it uncomplicated for business owners to meet their tax obligations on time.

8. Adequacy in Problem resolving:

These reports point to the issues that help the users resolve problems effortlessly, and they make sure that the employees are compensated appropriately and that all the tax obligations are met on time.

What are the ways to create a payroll report in QuickBooks?

Creating payroll report in QuickBooks is very easy. Here’s how you can create payroll manually:

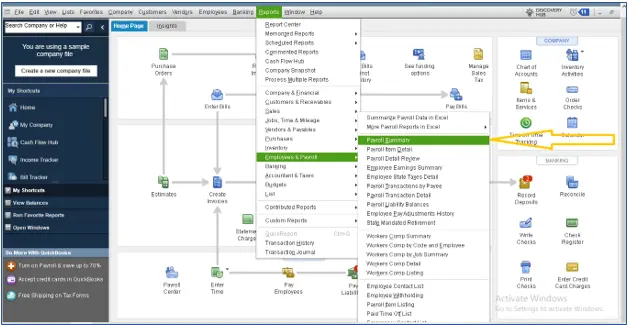

- First of all, open QuickBooks from your desktop, and then click on the Reports section.

- After that, select Employees and Payroll and then click on Payroll Summary.

- Now, select a date range.

- Further, click on refresh.

- Then, you need to delete the hours and rate columns.

- Here, you need to tap on Customize Report and also delete the rate, and uncheck the boxes of hours from the display tab.

- Click on OK and from the filters tab add pay periods.

- Lastly, click on Print and end the process by tapping on the report to take the printout of the payroll summary.

What are the ways to Edit the Payroll Report in QuickBooks?

There will be times when you will want to edit the payroll report because of some mistakes or to make modifications to the report. If you want to edit the report then follow the steps given below:

- To begin with, open QuickBooks, and from there go to the menu bar and click on the edit option.

- Now, make the modifications as per your need.

- In the end, click on the run report to see whether the changes have been made in the report or not.

What are the ways to run a report for a particular employee?

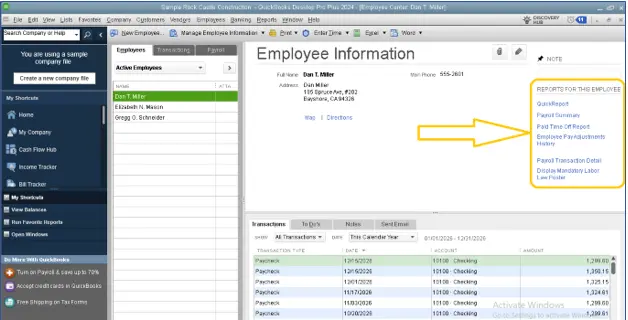

- To initiate the process, go to the home page, and then click on the employees’ section to open the Employee Center.

- After that, from the left side, you need to select the employee you wish to run the report for.

- Then, go to the top right corner and there you will see options for the report, tap on the report you wish to run.

- Quick Report

- Payroll Summary

- Payroll Transaction Detail

- Paid Time Off

- Here, you need to type the dates you require.

- In case, you want to edit the settings of the printer, you can. Just tap on Print.

Need to view at a glance: Easy Solutions for Audit Trail Reports in QuickBooks Desktop

What are the ways to Export a Payroll Report to Excel?

Below are the steps to export a payroll report to Excel, the steps are easy to follow.

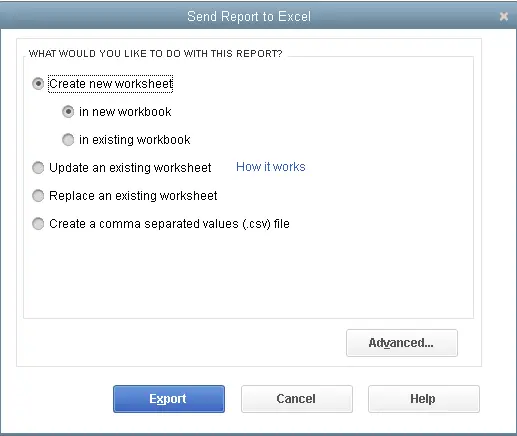

- To start the process, you need to click on the drop-down arrow in the provided report.

- Now, select Create a new worksheet. You can even select Update the present worksheet.

- In case, you select update the present worksheet, click on the browse button to choose the workbook.

- Further, tap on the Advanced button.

- After that, you need to remove the space between the checkbox columns.

- Then, tap on OK.

- To end the process, click on Export.

To sum up!

Now that you know about the payroll report in QuickBooks Desktop, it will become very easy for you to operate it manually. You can now use this to examine the work patterns of your employees.

However, it is very normal that these reports can get complicated sometimes for the users. If this is the case with you too, then you can contact our QuickBooks professionals on our Toll-free number +1(805)-419-9019.

They will be able to resolve your issue within a minute and will answer all the queries related to payroll reports in QuickBooks.

Related Post: Fix QuickBooks Error 30159 in minutes with 5 proven solutions