Mistakes are meant to happen in your life, business, or anywhere. Nothing is perfect in this world. But with some graceful edits or removal, we can surely make our mistakes look perfect. Similarly, making mistakes while creating invoices is very common, which you can fix by deleting. But the problem emerges when you don’t know how to delete an invoice in QuickBooks. You can face many consequences related to your financial data.

With this article, we will help you go through the steps to delete an invoice in QuickBooks which will make sure that your financial data is safe.

Whether any customer has canceled your order, you have made an input error, or you simply want to delete an invoice, we will give you all the necessary instructions to smoothly delete an invoice in QuickBooks.

What do mean by Invoice in QuickBooks?

Invoices are basically issued to the customer when they need an elongated payment period. It consists of the due date of payment, a description of the amount and number of products and services, or any kind of discount given.

Invoices are a kind of document that is meant to contain information related to transactions. Large Enterprises create invoices in QuickBooks monthly for customers and clients to send them. But there is no alternative for small enterprises, they make invoices depending on the transactions made.

Highly Recommended: Easy methods to create QuickBooks period copy

However, this may lead to issues like data loss, but for such situations QuickBooks allows their users to void or delete invoices to avoid problems related to it.

Note: Intuit offers their users QuickBooks Pro/ Premier/ Enterprise, QB online invoicing, etc. This helps users to send or create invoices.

Let’s Distinguish between Voiding and Deleting an invoice in QuickBooks

In QuickBooks, voiding and deleting an invoice are two different things, and it is important for you to know the differences between them.

Deleting an invoice

The purpose behind deleting an invoice can be conclusive, this step is executed when you want to delete any element of the transaction. In this, you need to delete an invoice and its related transactions completely from QuickBooks Records.

When you delete/ remove an invoice, you remove the element of the transaction of your financial reports. It gets entirely deleted as if it was never there. But the good thing about this is it won’t affect your financial statements.

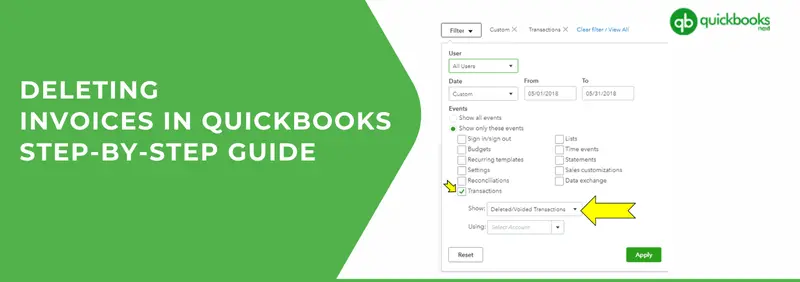

When you delete an invoice, it automatically gets erased from your active records, and with the help of the QuickBooks audit trail, you will be able to trace its removal.

Voiding an invoice

The main purpose of voiding an invoice is when you don’t want to entirely delete an invoice from your records, just canceling some transactions will work. It shows that the invoice is no longer legitimate, because of some mistakes.

When you void an invoice, it doesn’t get removed completely but it is still present in the reports. It continues to keep an existence of the original transaction in your financial reports. Although it makes the amount zero to make sure that your statements don’t get harmed, it is still present but with a zero amount.

Unlike deleting an invoice, voiding does create an audit trail. It starts making voided transaction entries which helps you in tracking or documenting any alteration.

Important: you need to be very careful about voiding or deleting an invoice, choose the one that satisfies your accounting practices or you might face consequences.

Points to be noted before voiding or deleting an invoice in QuickBooks

Before proceeding with the steps of voiding and deleting, you need to keep some points in your mind. It would help you decide whether to execute such steps or not or you want to void or delete an invoice in QuickBooks.

Cases in which deleting an invoice is better:

- You can only delete deposits like purchase orders, supplier credits, late fees, delayed credits, estimates, etc., and not void them.

- You can delete any type of transaction in QuickBooks but this is not the same for void.

- You can delete transactions when you know that the records won’t be needed in the future, as they will get deleted permanently.

- Deleting an invoice is always a better option when you know what reports are not needed in the future and you want to completely remove it.

Cases in which voiding an invoice is better:

- You can void an invoice when you need transaction records like reference number, vendor name, etc. to be voided which means not completely deleting it but keeping it aside as you might need it in the future.

- If you wish, you can attach any payment to other invoices while voiding.

- You can easily recover a transaction from QuickBooks when voiding an invoice.

- Also, you can recover a few things from your audit trail.

It is totally based on your permissions, whether you want to provide everyone the authority to void or delete an invoice. Make sure that the permission is given to very few of your employees.

I would suggest that avoid deleting or voiding an invoice except when necessary. I have seen that keeping a glassy audit trail makes sure that your data integrity is good and transparent.

Steps to delete an invoice in QuickBooks

Deleting an invoice in QuickBooks is a conclusive action. You won’t be able to get that invoice in the future. It completely makes the invoice disappear from your records. So, think twice before deleting an invoice.

Also, in case you have taken out the print or saved an invoice as a PDF, then removing an invoice is the safe option.

- First of all, go to your desktop, and open QuickBooks.

- After that, log in and enter your admin credentials.

- Now, choose the invoice of the company file.

- Go to the left navigation menu and click on transactions.

- Further, tap on sales.

- In this step, you need to select the one you want to delete, from the list of transactions.

- Tap on More and then on Delete under the drop-down menu.

- A confirmation box will appear on the screen, tap on yes.

- You can repeat the same steps if you want to delete any other transaction.

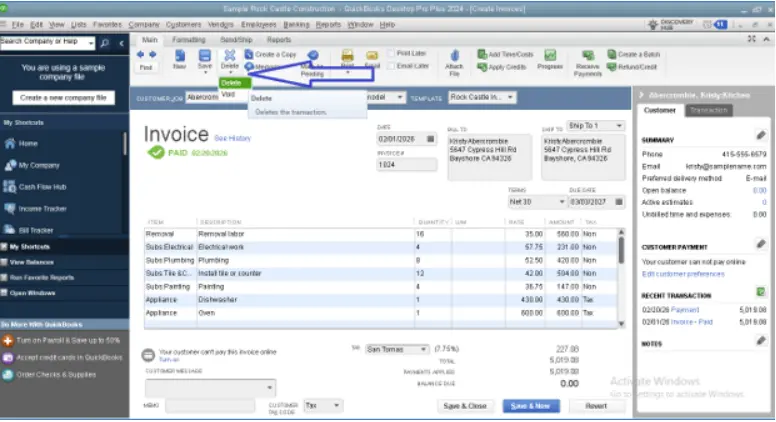

Steps to void an invoice in QuickBooks

If you have issued the invoice to your client by now, then in that case rather than deleting you should void the invoice. Voiding is always a better option when you know that the transactions will be needed in the future.

In this, the amount comes to zero and is removed from your system but details such as services remain, invoice number, and products are still there for you to trace the invoice in future.

- Here’s how you can void an invoice in QuickBooks:

- Initially, open QuickBooks, then tap on the ‘Create invoice’ option.

- Select and then open the invoice you wish to void from the transactions list.

- Go to the menu bar and then tap on edit.

- At the bottom of the webpage, you will find the option ‘Delete’ or ‘Void’.

- You need to tap on the void.

- Lastly, to apply the modifications, hit save and close.

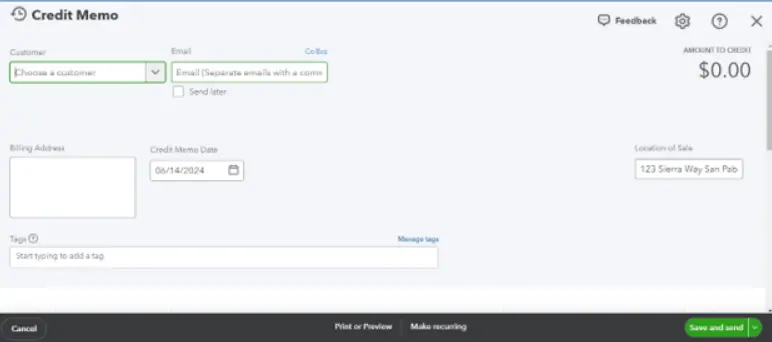

Steps to void last year’s invoice

If you want to void the invoice from last year, then proceed with the steps below:

- To begin with, open your QuickBooks from your desktop.

- Now, look for the ‘+’ icon, and tap on the ‘Credit memo’ option.

- After that, select the client’s invoice you wish to void.

- Here, you need to fill the boxes with the client’s details and the amount you want to void.

- Further, to create a credit memo, click on save and close.

- Finally, the invoice will be voided.

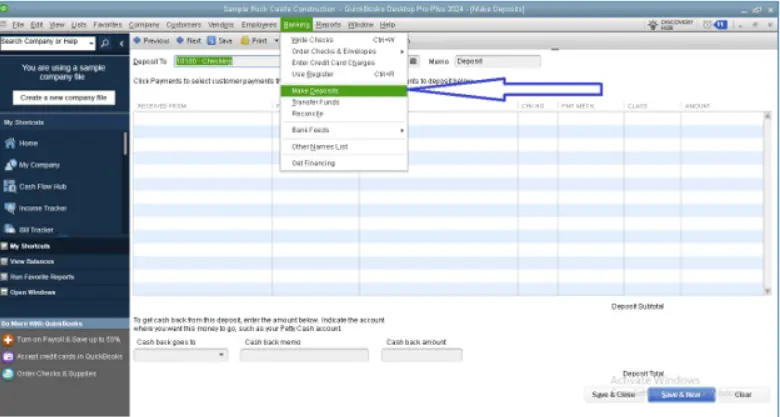

Steps to delete an invoice payment

There might come a time when you will accidentallypay any of your clients twice or add someone else’s invoice payment to another account.

Given below are the steps, to get away from invoice payment that is not required.

- First, tap on the company profile from the QuickBooks.

- After that, go to the banking menu and open the same thing mentioned above.

- Here, you need to click on the make deposit option from the drop-down menu.

- Further, choose the line and the duplicate invoice you want to delete.

- Click on the deleted line from the edit menu.

- In the end, to save the changes, tap on the save and close button.

To sum up!

In summary, voiding an invoice is flexible and can be reversed. It keeps an audit trail and doesn’t affect the impact on financial statements, whereas to delete an invoice in QuickBooks is more like a conclusive action that will remove the transaction permanently.

Through this article, we tried to make things as easy as possible, in case you are still stuck somewhere and don’t know what to do then feel free to contact our certified QuickBooks expert on the toll-free number +1(805) 419-9019 provided for you.