QuickBooks Payroll Services

Intuit is a leading provider of payroll services for small businesses. Their payroll platform allows users to easily manage and process their employees’ payroll, including calculating taxes, generating paychecks and direct deposit payments, and creating and filing government forms.

One of the key features of Intuit’s payroll service is its integration with QuickBooks, the company’s popular accounting software. This allows users to seamlessly transfer payroll data into their QuickBooks account, making it easy to stay on top of finances and keep track of employee information. Another feature of Intuit’s payroll service is its ability to handle multiple pay rates and pay types, including salaried and hourly employees. The platform also automatically calculates and files taxes, including federal and state taxes, as well as unemployment and workers’ compensation insurance.

Is your QuickBooks not calculating proper taxes? Or perhaps you are having trouble updating the payroll with the latest tax tables? We urge you to get in touch with our payroll service team immediately so that we may assist you in fixing the problems and getting back to work.

Intuit’s payroll service also offers a variety of additional features, including the ability to print checks and pay stubs, generate custom reports, and manage employee time off. There are also options for setting up direct deposit and electronic pay cards, giving employees the flexibility to choose how they get paid. Customers can choose from a variety of pricing options based on the number of employees and the level of service they need.

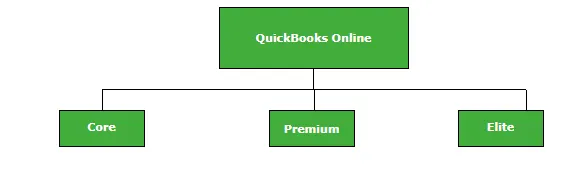

This should be noted that all the payroll plans for QuickBooks online include the Full-Service Plan or Full-Service Payroll, which gives you peace of mind to stay focused on your business. Intuit handles the automation and management of all payroll taxes and forms.

1.Core: Easily pay your team, file 1099s, automate your payroll with direct deposits.

2.Premium: With all the features for Core and added Same day direct Deposits, Expert Review and dedicated HR Support Centre is always with you at the time you need.

3.Elite: As it sounds, this is the most advanced version of the Intuit’s Online payroll which offers 24*7 expert support, Tax penalty protection, personal HR advisor etc as added benefits.

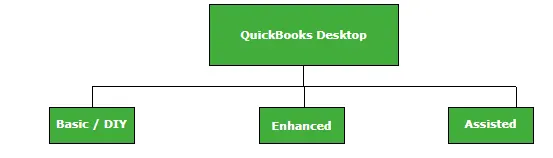

The QuickBooks Payroll service is not compatible with the Mac version of QuickBooks. For payroll processing on a Mac, we recommend Intuit Online Payroll mentioned above in the QuickBooks Online section of this webpage.

1.Basic: Basic Payroll for QuickBooks Desktop is the DIY payroll wherein you could manually calculate your payroll tax figures and enter them for each paycheck using Intuit free online paycheck calculator.

2.Enhanced: Federal and state payroll taxes are automatically calculated and tax payment deadlines are tracked for you through Enhanced Payroll. Payroll tax returns and payments can be filed and made online with e-file and pay. File and Re-print the W2 with in the QuickBooks.

3.Assisted: With all the features included of Enhanced payroll Assisted Payroll comes with assurance of no penalty guaranteed since Intuit handle your payroll tax payments and forms for you, guaranteed accurate and on time. If a tax issue comes up, we’ll work with the tax agency to help resolve it for you.

View My Paycheck Service: For employers who want to provide their employees with convenient 24/7 access to their own pay stub information, QuickBooks Workforce (workforce.intuit.com) is a useful tool. No more paper or postage needed to issue or replace missing or damaged pay stubs. Whenever an employee needs to view their most recent or past pay stubs, they need only log in to their QuickBooks Workforce account. This service is available for all platforms including QuickBooks Desktop and online.

-Guiding you through the setup process to ensure that everything is configured correctly

-Providing training and resources to help you navigate the software

-Assisting with troubleshooting and resolving any issues you may encounter

-Helping you integrate Intuit Payroll with other systems, such as accounting software

-Providing assistance with compliance, including filing taxes and other federal forms

-Ensuring your data is kept secure and confidential